Now you can use uCollect to help you reconcile your batch settlements that come in net of commissions/fees. If this is how your payment gateway does this you can simply tell uCollect the rates to use and we’ll automatically calculate the commissions and post this to your bank account! You can specify a fixed rate per transaction, a percentage of the transaction value, or BOTH! So long Stripe reconciliation nightmares!!

When reconciling in Xero/Quickbooks be sure to check the box that says “Show Spent Items” so that this transaction will display.

You’ll find the settings in the Add/Edit Payment Gateway section of the Edit Organisation screen.

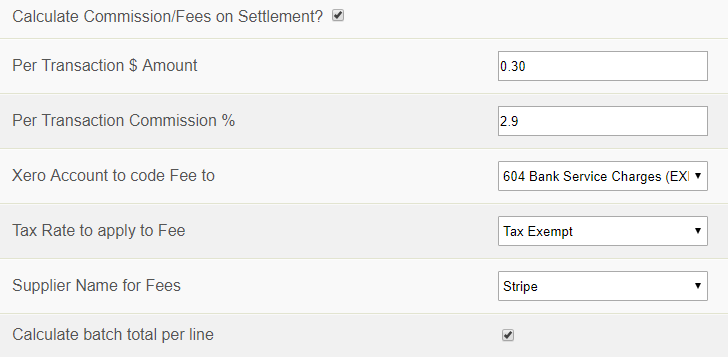

For standard Stripe fees (2.9% + 30c per transaction) you would set it up like this:

Here is the definition for each field:

- Per Transaction $ Amount: This is a flat rate applied to every collection amount. In the Stripe example this is the 30c per transaction authorization charge. Enter as a dollars (enter the 0 if there are no dollars) and cents amount (e.g., 0.30 not 30 or .30 for 30 cents).

- Per Transaction Commission %: This is the percentage amount that will be applied to the total collection. We round at 2 decimal places. This number should be entered as the percentage number not the math amount (e.g., 2.9% is entered as 2.9 not 0.029).

- Xero/Quickbooks Account to code Fee to: This is an account from your accounting system that the fee will be coded to. A spend money transactions will be created and coded to this account. You should choose something like “Merchant Fees” or “Bank Fees”.

- Tax Rate to apply to Fee: This is the sales tax rate that will apply to the fee portion only. Most countries do not charge sales tax on financial service transactions like this (so choose Tax Exempt or No Tax) but there are a few exceptions (such as Australia). If tax is charged then your $ and % rates should be tax inclusive.

- Supplier Name for Fees: This is the contact name that the fee will be assigned to. If the contact you want is not there you should create a contact first then re-edit this page to choose the correct one.

- Calculate batch total per line: By default we calculate the total fee based on the batch total (multiplied by the % rate) plus the number of collections (not invoices; multiplied by the $ rate). But some gateways (including Stripe) calculate their fee on each collection or line. The difference is usually only a few cents, but will make reconciliation harder. Check this box to force us to calculate line by line.

LIMITATIONS:

- This is a simple formula – rounding and reality may mean that your fees are a few cents out. We can’t read the actual fee from your gateway or tell when their rates have changed.

- Some gateways charge variable fees (e.g., in the US Stripe have different fees for ACH transactions, but they are all settled together; in Australia Stripe charge different rates for local Visa/MC card and the higher rate for Amex and foreign cards; and some CC gateways charge different rates for different cards). We can’t handle that so you should either create different gateways for different cards or switch this function off.

- When reconciling in Xero/Quickbooks and you check the “Show Spent Items” box sometimes the spend money item doesn’t show up – try clicking this box a couple of times. Xero/Quickbooks is a little flaky here!

- We do not charge this fee on to your customer.

- We cannot set an upper limit on the fee. If your gateway fee has an upper limit (e.g., 0.5% to a max is $5) we can’t yet handle that.

- If you process other payments through this gateway outside of uCollect then we won’t be include any fees for the other items.

- Some gateways include extra fees (such as Ezidebit adding the new customer fee) – we can’t spot that.

- If your gateway collects your fees in a separate transaction each month then you should not use this feature.